Simply fill out our “Start out Nowadays” Internet sort to have money right now! Title pawning with us is easy, and an effective way so that you can get your hard earned money. We will maintain on to the title, so you might only be pawning your title and never the auto.

Hunt for a pawn store with a strong reputation within the Neighborhood and positive testimonials from earlier shoppers.

A car or truck title mortgage, or “pink slip loan,” enables you to borrow between twenty five percent to fifty p.c of the worth of one's car in exchange for giving the lender the title in your auto as collateral.

If you have already got a title loan with among our rivals, then there’s Excellent news in your case, much too. We could possibly refinance your title bank loan with TitleMax and obtain you a competitive desire level in the procedure!

Title loans can offer money to borrowers in a very money pinch. But They are really noted for charging exorbitant curiosity rates and often-sneaky fees, and therefore are most effective avoided Should the borrower has any other different.

Mississippi In case you’re eighteen many years previous and also have a sound govt-issued ID, Then you certainly’re midway to obtaining permitted to get a Mississippi title financial loan with TitleMax. The only other item you’ll need to have is a motor vehicle with a transparent (lien-no cost) title.

“If you're able to’t fork out back again the bank loan when it’s due, it’s rolled over into A further cycle with extra expenses,” states Bruce McClary, senior vp of communications for the Nationwide Foundation for Credit rating Counseling.

two Particular Unsecured Financial loans/LOCs: Unsecured loan quantities and products not accessible in all shops/states. 1st time utmost For brand new personalized bank loan shoppers differs by state; initial time more info max is $600 in MS; $800 in SC; $1000 in other marketplaces. Better amounts can be accessible for return borrowers. In-Keep: In-man or woman application not accessible within the point out of Idaho right now. Account approval necessitates pleasure of all eligibility needs, such as a credit history inquiry. Herald active banking account information (dated within the past 60 times), and a valid govt-issued ID to use. If your checking account assertion won't demonstrate recurring earnings deposits, you have got to also usher in proof of money, just like a paystub, from throughout the final 60 times.

If you wish to get fast funds, and you've got the title to your automobile, title pawn can assist you utilize the fairness that you have as part of your car, obtaining the income you would like right now is rapidly and simple with title pawning.

We keep a firewall amongst our advertisers and our editorial staff. Our editorial staff would not receive immediate payment from our advertisers. Editorial Independence

On the other hand, before you make any hastened selections, Permit’s comprehend the intricacies if you pawn a vehicle title and the reasons individuals go for it.

Lengthier Repayment Conditions: Car or truck title loans normally include lengthier repayment terms. This allows borrowers more the perfect time to repay the financial loan, most likely leading to reduced month to month payments.

The commonest type of a title financial loan is a car title bank loan. In this case, a potential borrower is needed to personal an auto outright also to sign the car's title above to your personal loan business.

After they are saying Of course towards your title loan, they give you the cash you will need. The amount can alter depending on your car’s value and if you can pay out back the money.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Lacey Chabert Then & Now!

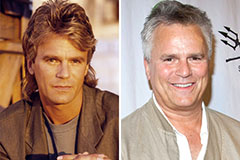

Lacey Chabert Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!